Credit Agricole Moves to Shield Italy Business Against UniCredit

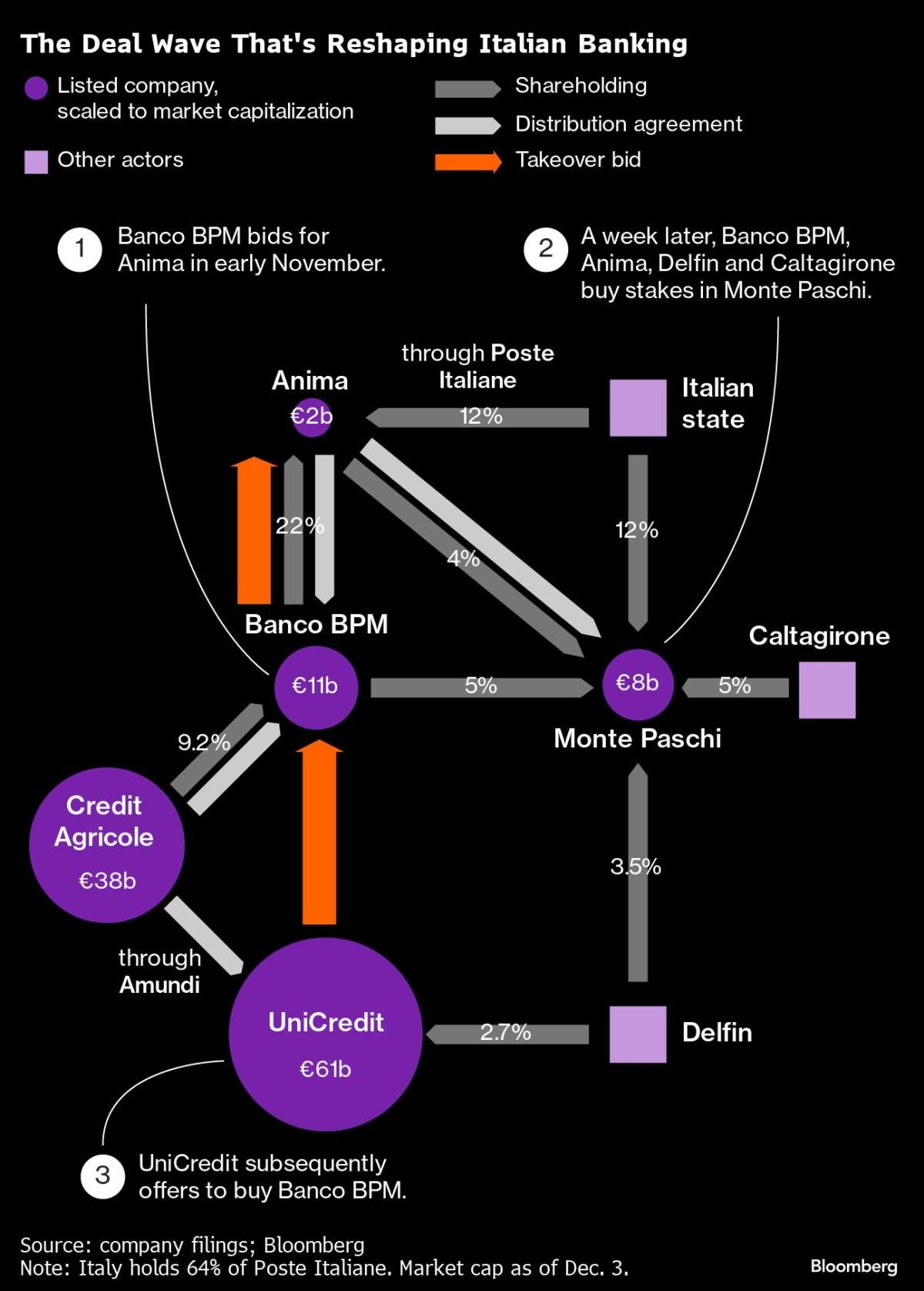

(Bloomberg) — Credit Agricole SA’s decision to boost its stake in Banco BPM is aimed at protecting its business interests in Italy after UniCredit SpA made a takeover bid for the smaller Italian competitor.

Most Read from Bloomberg

The increase in the French bank’s holding to about 15% from 9% previously will give Credit Agricole CEO Philippe Brassac a stronger position in negotiations of its commercial agreements with both Banco BPM and UniCredit, as they’re key for its revenue generation in Italy, people familiar with the matter said.

Credit Agricole has a complex network of relationships with both Italian banks. The Paris-based company is a major partner for Banco BPM in consumer credit and non-life insurance joint-ventures, while its asset management arm Amundi SA relies on UniCredit for much of its sales in Italy.

Credit Agricole plans to use its stake as leverage in expected discussions with Banco BPM and UniCredit to underpin its position in the country.

Brassac and UniCredit CEO Andrea Orcel have been trying to schedule a meeting for the next few weeks to discuss the Italian bank’s takeover bid, Bloomberg News has reported.

An extension of Amundi’s contract and the sale of minority holdings in Banco BPM’s consumer credit unit Agos Ducato will be part of the negotiations, some of the people said, asking not to be identified discussing the private information.

Representatives for Credit Agricole and Banco BPM declined to comment. The news of Credit Agricole’s increased stake in BPM “changes nothing” for Unicredit, a spokesman for lender said in a LinkedIn post Saturday, adding that it is always prepared to negotiate with the French bank.

The 15% stake in Banco BPM makes Credit Agricole its largest shareholder by far after UniCredit two weeks ago offered to buy the smaller Italian entity. A successful bid by UniCredit would make it the largest Italian bank by total assets, ahead of Intesa Sanpaolo SpA.

Italy’s government endorsed a plan by Credit Agricole to buy more shares in Banco BPM, with Prime Minister Giorgia Meloni’s administration said to have given informal approval, Reuters reported on Saturday. Brassac called his counterparts at the two Italian lenders, as well as the Italian government, to inform them it had boosted its stake just few hours before the announcement, the people said.

Separately, Banco BPM is considering a request to Consob, the Italian market regulator, for an exemption from the so-called passivity rule, which prevents a company targeted by a takeover to take strategic actions, Il Sole 24 Ore reported.

https://s.yimg.com/ny/api/res/1.2/i3SeDJ4X.VuikxD6GUqxlg–/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD0xNjc2/https://media.zenfs.com/en/bloomberg_markets_842/a0814d2435a6983bae1869d28663a1b2

2024-12-08 10:20:21