The roller coaster of scaling a next-gen materials startup

The strategy has been updated in two ways. Firstly, the renewed focus is on improving the customer offer. For the Fashion Futures audience, Helmersson set out some of the biggest questions it is seeking to address: “What can we do to get down in price? How can we get up in volume quicker? How can we make the offer broader by adding services, like coordinating a [brand’s] supply chain?” The latter would help its onboarding of larger brands and increase production volumes, she said — which would result in greater efficiencies and, by extension, better prices.

Secondly, the team is reviewing its production processes, including the feedstock. “So far we’ve been using industrial waste, but the long-term vision is to deal with post-consumer waste. It’s part of the strategy to find the right partnerships [to enable that],” said Helmersson.

Production ground to a halt in February, though Circulose said at the time that it had enough pulp and fibre in stock to fulfil brand orders for 18 to 24 months. The ambition is to get it back up and running by the start of 2026. “We will ramp up the production when we know the demand,” explained Helmersson.

Circulose’s success relies on that demand. Brands only had so much appetite to support Renewcell — has that changed? “More brands have targets [to use] sustainably sourced or circular materials,” Helmersson said. But she acknowledged that Circulose’s biggest challenge will be to convince brands that their feedback has been heard, especially on the price. “We’re going into a phase where that dialogue will become more and more active.”

Comments, questions or feedback? Email us at feedback@voguebusiness.com.

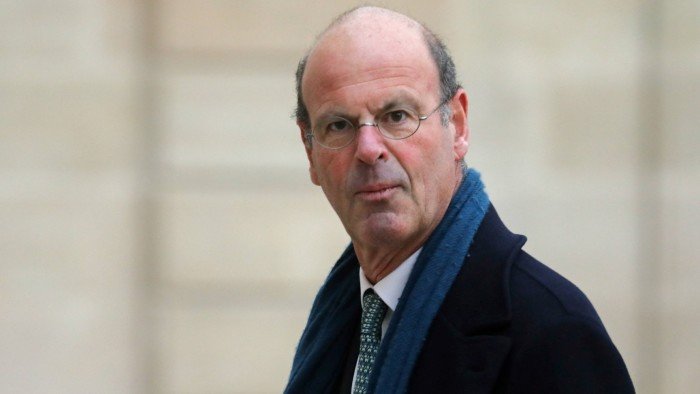

https://media.voguebusiness.com/photos/6753344b16facec339f3fd6c/16:9/w_1280,c_limit/FF-HELENA-VOGUEB-61224-SOCIAL-NEWSLETTER.jpg

2024-12-09 05:50:00