What It Means For Bitcoin’s Security

Quantum computing breakthroughs and bitcoin security

The recent announcement by Google CEO Sundar Pichai about their new quantum computing chip “Willow” has caused a few waves in the Bitcoin investment community and was like chum in the water for Bitcoin skeptics. Geiger Capital sent a viral tweet declaring “Bitcoin is dead” as a joke, but scores of skeptics jumped at the chance to disparage bitcoin. Every few years, perhaps instigated by Google’s successive chip announcements, quantum computing (QC) fears involving bitcoin catch on in the news cycle. But are the fears justified? Is Bitcoin truly at risk of being “cracked” by quantum computers?

In this post, I’ll explain the basics of quantum computing, how Bitcoin’s cryptographic design works, and examine why QC is far from posing a real threat. We’ll also explore how Bitcoin’s cryptography can evolve if needed, putting these fears into perspective.

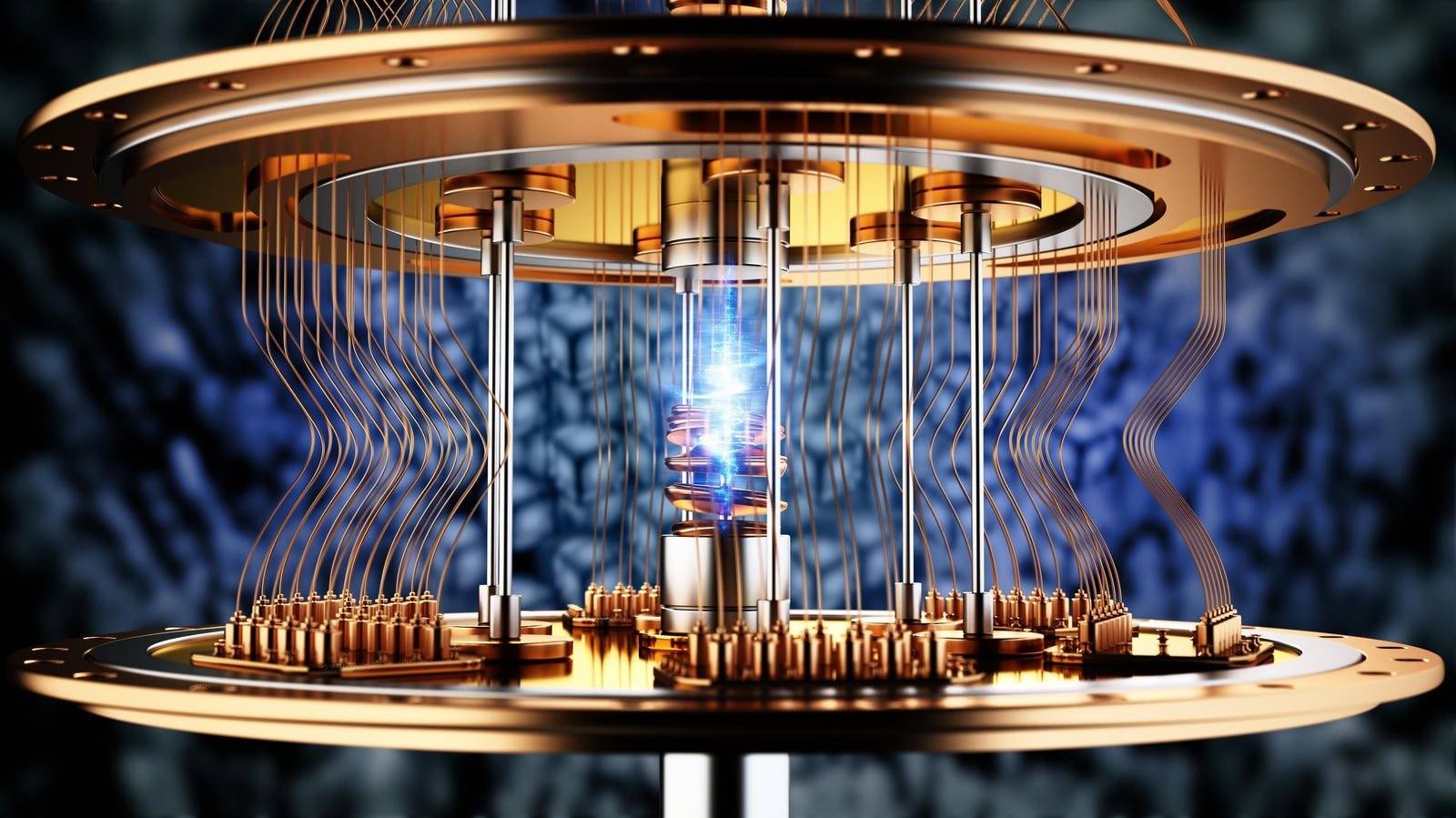

Quantum Computing 101

At its core, quantum computing is a revolutionary approach to solving math problems. Unlike classical computers that use bits (0s and 1s), quantum computers use qubits, which can exist in a state of 0, 1, or both simultaneously—a phenomenon called superposition. This allows quantum computers to perform certain types of calculations exponentially faster than traditional computers.

Quantum computers also leverage entanglement, where the state of one qubit is directly related to another. They use previously designed quantum algorithms like Shor’s and Grover’s to solve mathematical problems that would theoretically take classical computers billions of years.

But there’s a catch: current machines are error-prone, require extreme conditions like near-absolute-zero temperatures, and are far from the scale needed to tackle real-world cryptographic systems like public key cryptography or Bitcoin.

Bitcoin’s Cryptography And The Quantum Threat

Bitcoin relies on SHA-256, a cryptographic algorithm that secures its proof-of-work mining, blockchain and modern wallets. This cryptography ensures that Bitcoin is highly resistant to traditional computing attacks from rewriting history or cracking private keys and stealing funds. For instance, brute-forcing a Bitcoin private key would take 2256 operations—a number so large it’s effectively impossible.

Quantum computers, theoretically, could use Grover’s Algorithm to reduce the required operations to 2128, making the problem more approachable in principle. However, this still demands computational resources on a scale humanity is far from achieving. For example, the University of Sussex estimates that breaking SHA-256 within a practical timeframe would require 13 million to 317 million qubits, depending on the desired speed of the operation. By comparison, Google’s Willow chip has just 105 qubits.

Moreover, Bitcoin developers have been aware of the potential quantum threat from the very beginning. Bitcoin creator Satoshi Nakamoto addressed the threat in 2010, and the quantum commuting page on the Bitcoin wiki was created in 2016. Bitcoin’s best practices were also created with this kind of attack in mind. It is standard to use addresses only once in wallets, which minimizes exposure to these threats. Public keys and the associated signature are only revealed when a transaction is sent but before it is confirmed, giving a quantum attacker only a short window to compromise the key before funds are moved to a new key in the new block.

Satoshi Nakamoto about SHA-256 and quantum resistance

Quantum Hype Versus Reality

Physicist Sabine Hossenfelder has critiqued Google’s quantum supremacy claims as exaggerated. She noted that similar claims in 2019, involving a 50-qubit chip, were quickly questioned by IBM and later replicated on conventional computers within a comparable timeframe. According to her, while the Willow announcement is scientifically impressive, “the consequences for everyday life are zero.”

Mathematician and computer scientist Gil Kalai echoed this sentiment. In a blog post from the day of the Willow announcement, he urged caution, saying “Google Quantum AI’s claims (including published ones) should be approached with caution, particularly those of an extraordinary nature. These claims may stem from significant methodological errors and, as such, may reflect the researchers’ expectations more than objective scientific reality.”

By most measures, quantum computing remains in its infancy. Advancements like Google’s Willow chip are far from capable of cracking SHA-256 or disrupting Bitcoin’s network. Long before reaching that point, other cryptographic systems, such as RSA and ECC—widely used in financial services, secure messaging, and military applications—would likely be compromised, as they are more vulnerable to quantum attacks than hashing algorithms like SHA-256. This means Bitcoin is arguably more secure than many of today’s traditional systems.

The energy requirements and costs of large-scale quantum computing operations would initially be economically prohibitive, limiting them to governments or major corporations. These entities, however, have strong incentives to avoid destabilizing markets by using quantum computing maliciously.

Known risks to Bitcoin would be priced in long ago

Additionally, if quantum computing posed an immediate threat to Bitcoin, it would already be reflected in its market price. The first experimental qubits were demonstrated in 1998, predating Bitcoin by a decade. This long development timeline has given markets ample time to price in the potential trajectory of quantum computing and its implications for Bitcoin’s security—even influencing Bitcoin’s design from the outset.

Bitcoin Can Adapt If Necessary

Quantum computers represent an exciting frontier in technology, but remain far from posing a credible threat to Bitcoin’s cryptography. As QC advances, Bitcoin may become vulnerable, however, only after other cryptographic systems with weaker encryption are attacked first, like banks and military applications. QC progress is uncertain, but extrapolating from improvements in the last 5 years this worry is still decades away. In the meantime, Bitcoin already has established solutions. Its decentralized nature allows for protocol updates of the nature necessary to address these vulnerabilities. Quantum-resistant algorithms like Lamport signatures and new address types via soft forks have been discussed for years.

The latest eulogies for bitcoin surrounding the Willow chip announcement are more about confirmation bias among skeptics than any defects in Bitcoin. Bitcoin is not dead. Far from it. With robust existing cryptography and a clear path to quantum resistance if needed, Bitcoin is more resilient and forward-looking than other technologies potentially vulnerable to the quantum computing threat.

https://imageio.forbes.com/specials-images/imageserve/675b55f62e8f078fc71b1fa0/0x0.jpg?format=jpg&crop=3524,1981,×0,y0,safe&height=900&width=1600&fit=bounds

2024-12-12 21:51:04