Why is the crypto market up today?

- Bitcoin reclaimed the $100K level as US November’s inflation data aligned with expectations.

- Market participants expect the Fed to cut rates by 25bps due to the steady inflation figures.

- The general crypto market also saw an uptick of over 4%, with major altcoins like XRP, SOL and ADA leading the rally.

Bitcoin (BTC) surged above $100K on Wednesday following the release of the US November Consumer Price Index (CPI) data, which came in line with expectations at 2.7%. Crypto investors quickly reacted to the report as market participants now anticipate that the Federal Reserve (Fed) will cut rates by 25 basis points (bps) next week.

Bitcoin pushes past $100K as CPI data stirs crypto market rally

US CPI data for November rose to 2.7% YoY from 2.6% in October, in-line with market expectations. Monthly CPI rose 0.3% in November, slightly higher than 0.2% in the previous month. Notably, core CPI stood at 3.3%, unchanged from the rise in October.

The CPI data aligned with expectations as market participants anticipate a 25bps interest rate cut by the Fed next week. A potential rate cut by the Fed could boost demand for risk assets like cryptocurrencies as investors begin favoring higher-yield investment products.

This is evident in Bitcoin’s 6% rebound above $100K on Wednesday following the CPI release. The crypto market also witnessed a significant boost, rising over 4% in the past 24 hours.

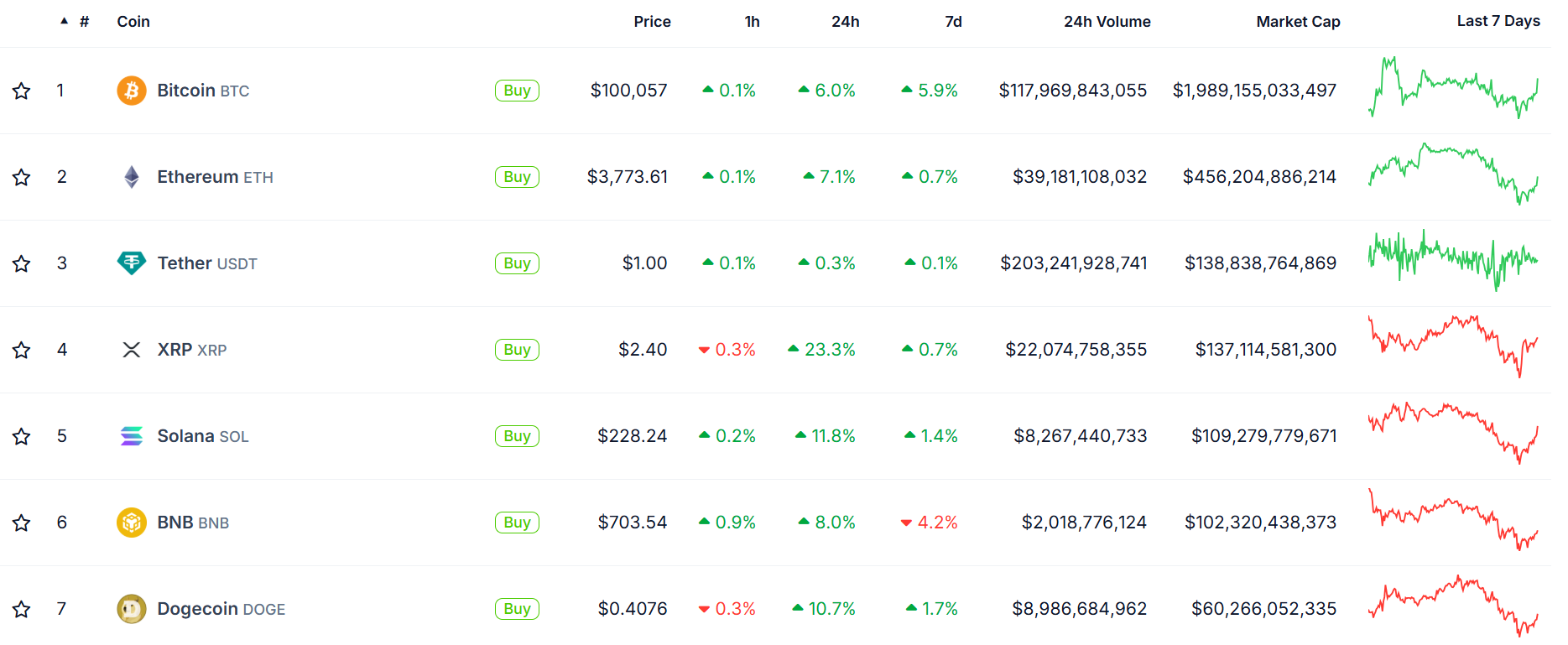

The top altcoins leading the rally include XRP, Solana (SOL) and Cardano (ADA), which have seen gains of 23%, 11% and 16%, respectively.

Top Cryptocurrencies | CoinGecko

Other sectors also responded well to the inflation data. Several meme coins, including Dogecoin (DOGE), Shiba Inu (SHIB), dogwifhat (WIF), BONK and FLOKI, saw double-digit gains.

Likewise, the artificial intelligence token sector jumped over 7%, with top AI tokens rising over 10%.

However, despite the immediate signs of a crypto rally following the CPI data, James Toledano, the COO of Unity Wallet, warned that investors should tread with caution when dealing with assets like Bitcoin, based on its volatile history.

“Bitcoin has a history of extreme volatility, and that calls for caution because corrections always come,” Toledano told FXStreet. “The pendulum swings both ways and for new entrants to Bitcoin, I’d caution going all-in when the price is at an all time six figure high, especially when the latest sugar hit is largely based on sentiment towards the incoming US administration.”

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Bitcoin/bitcoins-52602600_Large.jpg

2024-12-11 18:45:21